|

Employers: Social Security Tax Deferral----Hmm, Maybe Not

Sep 2, 2020

Business owners:

Let's first start by reminding you that this is an optional process. You don't have to participate. It is not mandatory.

Okay...read on...

IRS gave guidance a couple of days ago regarding Pres. Trump's Social Security Tax Deferral initiative.

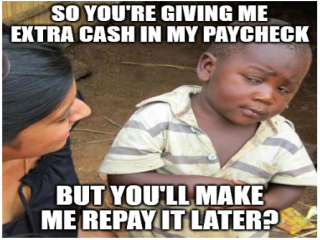

In case you don't know what that is, Pres. Trump has authorized employers to defer Social Security taxes from employee payrolls between 9/1-12/31 2020, but to repay it by 4/30/21. He has stated that if he gets reelected, he'll make sure to forgive the balances. However, that is not a certainty on two levels. First, he may not get reelected and secondly, only Congress has the power to legislate that forgiveness.

So the government envisions you to stop withholding SS from your employee's payroll between now and 12/31/20 (the "deferral" part) so that employees have a little more cash in their pocket while we [hopefully] get out of this COVID mess (stay optimistic out there!). FYI, there are 17 weeks in the deferral period.

The unsavory part is that, starting 1/1/21, they want you to go back to deducting the regular Social Security PLUS start deducting the amount that was deferred.

IRS guidance has stated that you--as the employer--will be responsible for making sure that you collect that deferred SS tax from your employees and repay it. That's a big blow for the idea.

They're giving you until 4/30/21 to repay or they'll assess late fees to any unpaid balance. Conveniently, there are also 17 weeks in the repayment period, which makes it a little convenient when calculating the repayment amount.

So, let's see how this works via an example:

Social Security tax is 6.2% of employee gross pay.

There are 17 weeks between 9/1/20-12/31/20.

There are 17 weeks between 1/1/21-04/30/21.

Let's say your employee usually makes $700/wk.

You deduct $43.40 every week for SS ($700 gross x 6.2%).

So the total SS tax deferred is $737.80 ($43.40 x 17 weeks).

Between 1/1/21-04/30/21, you're responsible for collecting and repaying that $737.80 back to IRS.

Most logical would be to deduct $86.80 for SS tax from your employee each week---the $43.40 you normally deduct PLUS $43.40 that was deferred.

Of course now, the employee will have LESS PAY in all paychecks between 1/1/21-4/30/21.

NOT COOL, boss (you know it's you they'll blame!).

On a side note, know that the employee doesn't have to repay weekly---you can make any arrangements you want. Heck, as a benevolent employer, you can even drag it out "0% for 60 mos" if you wanted to finance the process for them---you just better make sure Uncle Sam gets his full amount by 4/30/21!

And on a final note: what happens if an employee quits before the deferrals are repaid? Well, assuming there are enough earnings, you can deduct the full balance from their final paycheck (yay--more coolness points for you!).

But if their final paycheck isn't enough to cover it, you'll either have to track them down and try to collect any unpaid deferrals (good luck with that, Cool Ex-Boss!) or pay it out of your own pocket when it comes due 4/30/21 (just lick your wounds and go on...).

While it sounds good in theory, we're not sure we recommend the approach. Theory and real life sometimes don't match!

Category: Bookkeeping

|